kentucky sales tax on-farm vehicles

For Kentucky it will always be at 6. Kentucky Sales Tax Rate - 2022.

Ag Prepares For Electric Powered Future

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all.

. 650 Definitions for KRS 186650 to. Exempt from weight distance tax in Kentucky KYU. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

In addition to taxes car. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Motor Vehicle Usage Tax.

Aviation Fuel Dealers 51A131. Kentucky sales tax law includes numerous general agricultural exemptions but many do not apply to the equine industry. How to Calculate Kentucky Sales Tax on a Car.

For Kentucky it will always be at 6. Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky. State Tax Rates.

HB 487 effective July 1 2018 requires remote. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960. 650 Definitions for KRS 186650 to.

In the farm vehicles that will be traveling on federal state and county highways. Are services subject to sales tax in Kentucky. Beginning July 1 2018 when a dealership charges the customer for parts and labor on a vehicle repair job the associated labor will also be taxable if the parts are taxable to the customer.

Kentucky levies a sales tax of 6 of the gross receipts derived from retail sales of tangible personal property and digital property and the furnishing of certain services. Exempt from additional fuel usage tax in Kentucky. For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals.

Equine Breeders 51A132 Remote Retailers. For vehicles that are being rented or leased see see taxation of leases and rentals. For example Kentucky exempts from tax feed farm.

To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006. For example Kentucky exempts from tax feed farm.

Ag Prepares For Electric Powered Future

How To File And Pay Kentucky Kyu Weight Distance Tax Step By Step Youtube

Ford Brothers Fall Farm Machinery Vehicles Equipment Recreational Vehicle Online Consignment Auction

Exemptions From The Kentucky Sales Tax

Heavy Duty Trucks For Sale In Kentucky 330 Listings Truckpaper Com Page 1 Of 14

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Can You Drive A Farm Truck Without A License Farming Base

Sales Tax Laws By State Ultimate Guide For Business Owners

Kentucky Solar Farm Invite Is Not Sitting Well With Rural Neighbors

Kentucky Sales Tax Exemption For Manufacturers Agile Consulting

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

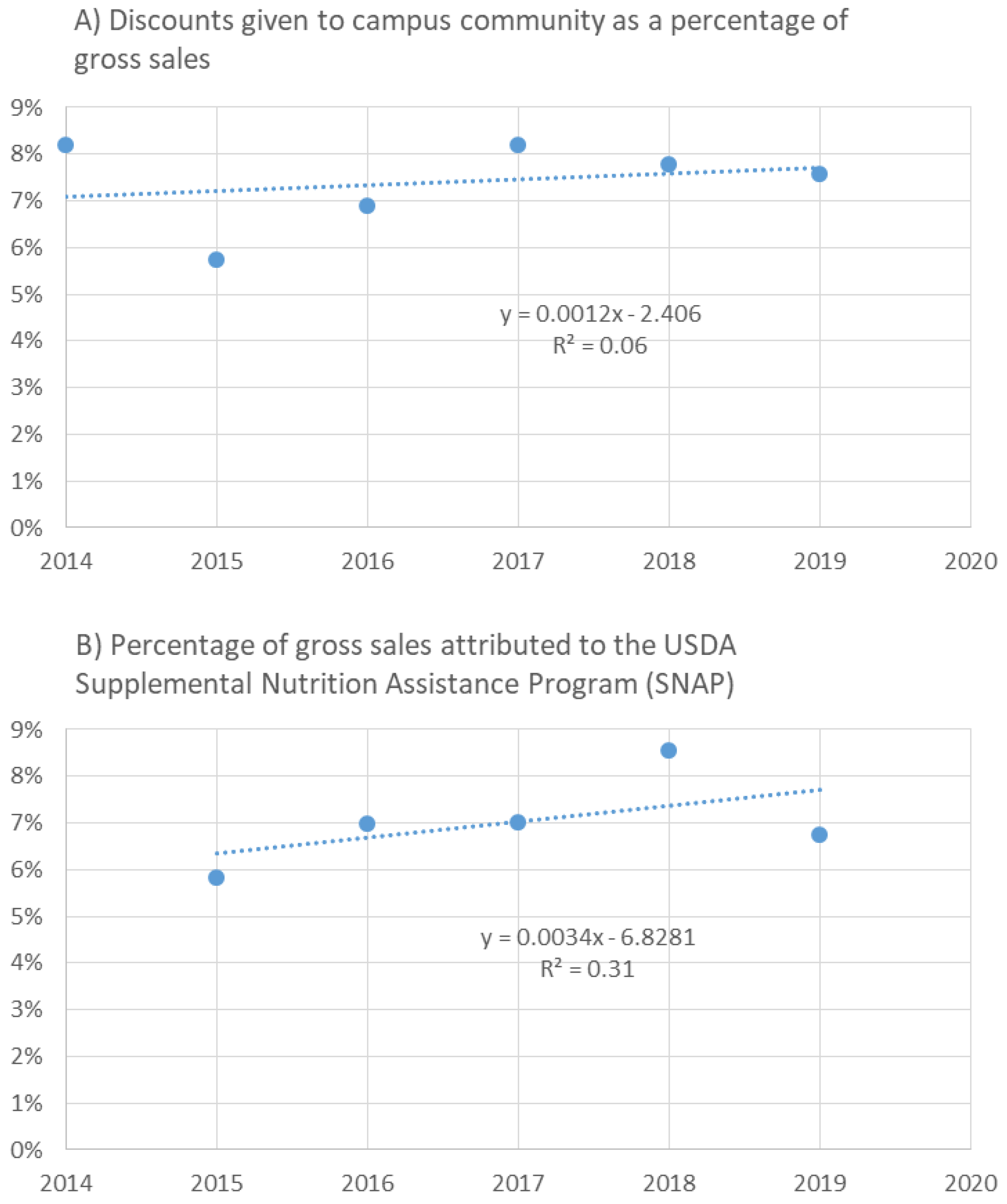

Sustainability Free Full Text Financial Viability Of An On Farm Processing And Retail Enterprise A Case Study Of Value Added Agriculture In Rural Kentucky Usa Html

Tangible Personal Property State Tangible Personal Property Taxes

Agricultural Exemption Number Required For Tax Exempt On Farm Purchases Morning Ag Clips

Update On Agriculture Exemption Number For Sales Tax Exemption On Farm Purchases Agricultural Economics